Payments | Understanding all basics about Payments 101

Processing Procedures Depend on the Platform and Sales Method

When a customer swipes a card or enters payment information online, funds will move from the customer’s account to the merchant’s. But, how do the funds move from one account to another? How long does it take? Are there costs involved?

The way in which your transactions are processed and how funds are made available for use will depend on the platform you use to process payments and the method you use to acquire customers for your hotel.

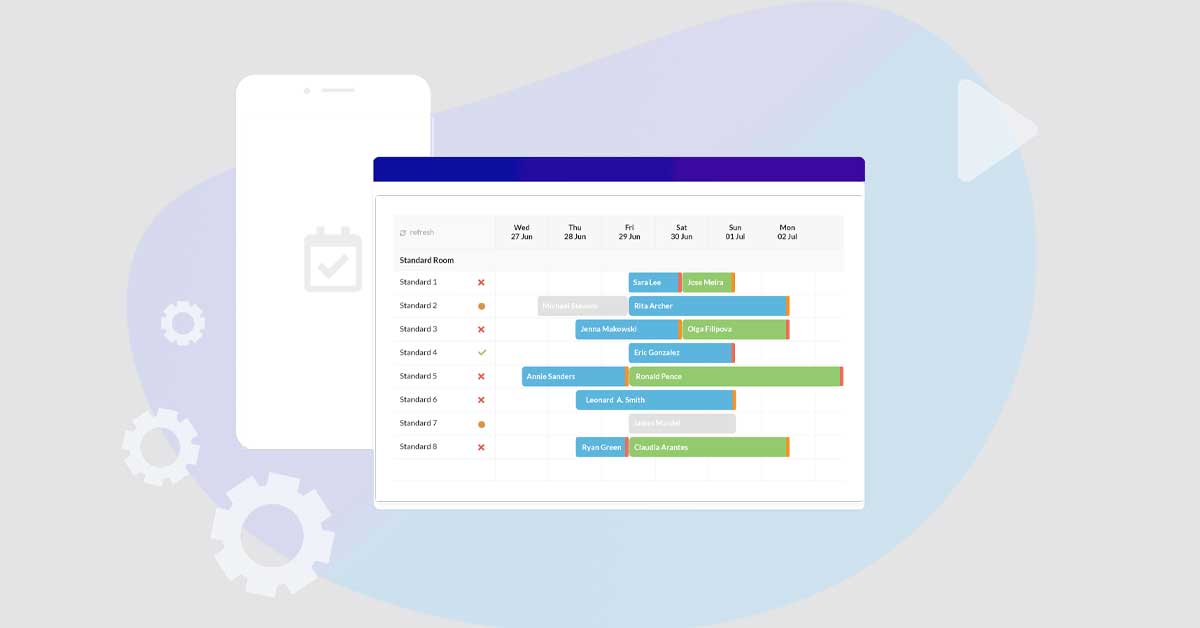

Online payment processing differs from in-person transactions. For example, processing payments with PayPal is vastly different from transacting with a traditional merchant account and swiping a customer’s card at the desk in front of them. Furthermore, an embedded payment system like Hotel Link Pay grants the ability to combine all the operational details for a customer with their payment details. In many cases, saving valuable time and mitigating human error.

In this article, we’ll explain how online payments are processed at a high level and the players involved.

First of all, we need to go through important terms often used in the payment process especially in hotel industry and regarding all players:

Consumer: Guest, booker

Issuer: The bank that provides the consumer with a credit or debit card.

Merchant: Hotel or Accommodation Provider

Merchant Account: Online payment service allowing a merchant to take online payments

Acquirer: The financial institution that provides the merchant account.

Processor: The link between the acquirer and the merchant. The processor attends to all the payment processing tasks but does not connect directly to merchants or consumers. They use Payment Gateways to integrate into platforms and websites on their behalf.

Payment Gateway: The actual portal that connects the merchant to the processor, similar to a POS system for in-person transactions. Examples include Hotel Link Pay, Stripe and Kovena.

Scheme Networks: Networks that provide branded cards (MasterCard, Visa, etc.) to consumers and facilitate payments for merchants.

The Stages of Payment Processing

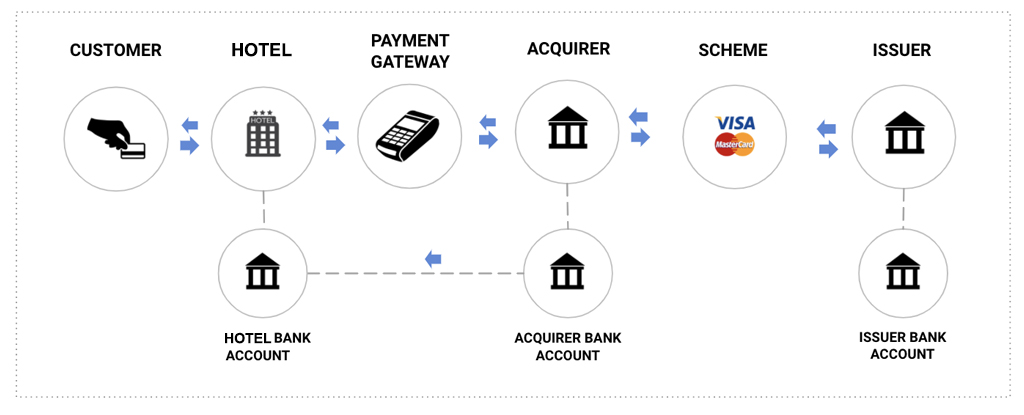

There are four primary stages of payment processing for online transactions. Below is a diagram of a typical payment flow.

The diagram of a typical payment flow.

Authorization is the initial phase of a transaction. The cardholder (guest) initiates a sale, prompting the merchant (hotel) to request authorization from the customer’s issuing bank.

If the issuing bank grants authorization, it means the cardholder’s (guest’s) account is in good standing, there are sufficient funds to cover the sale, and the card hasn’t been reported lost or stolen. The merchant (hotel) can proceed with the sale. If the bank does not grant authorization, it means there is an issue with the account and the transaction should be terminated.

The entire authorization process takes place in a matter of seconds, but it does not finalize the sale. There are still several other stages that must be completed.

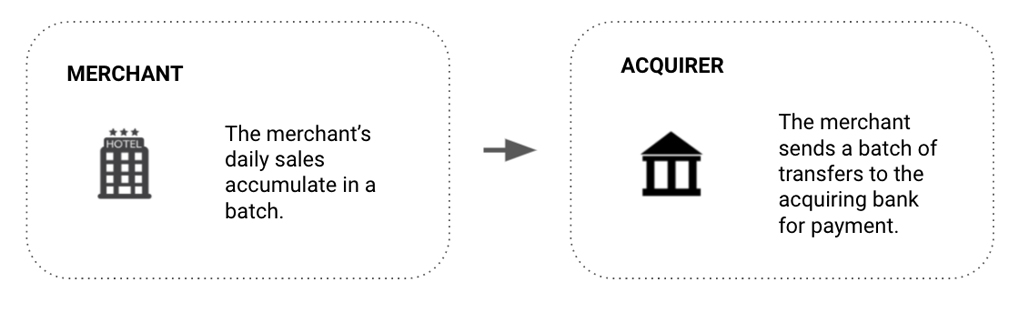

The next step in the process is batching.

Rather than using real-time data transmission to submit individual transactions to be paid one at a time, it’s generally considered more efficient for merchants to store transaction data and submit it in a batch.

Not only is this process more efficient but it also provides time to manually review each order and check for indicators of fraud. If fraud is detected, the transaction can be terminated. But if transactions are processed immediately without the manual review process, there is a strong likelihood that unauthorized transactions will be overlooked and the resulting chargebacks will cause significant revenue loss.

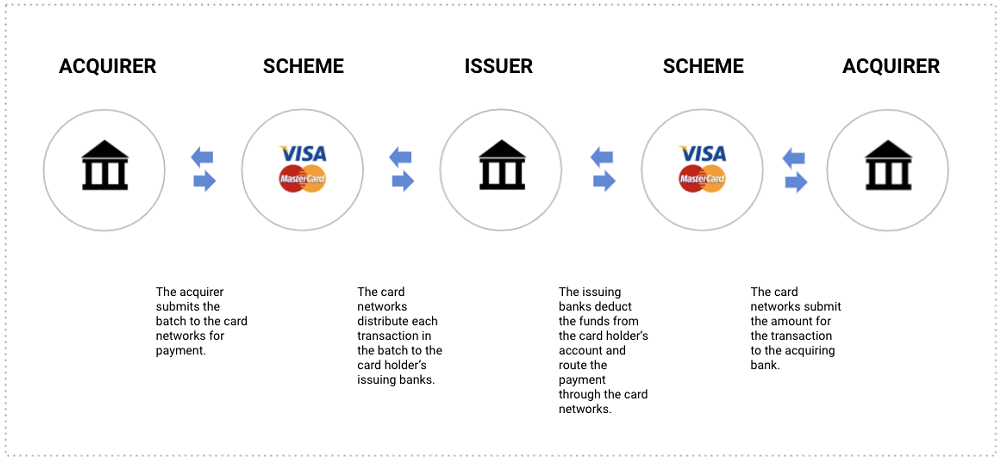

At the next step in the cycle, the acquirer accepts the batched transactions from the processor and forwards them to the card networks. The card networks then distribute the payments to the corresponding issuer.

The issuer debits the cost of the transaction from the cardholder’s account, then routes those funds back to the acquirer via the card network.

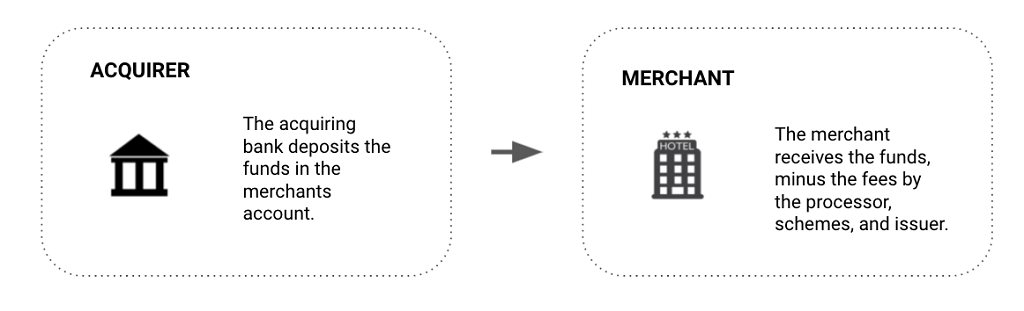

Funding is the last step in the process, at which point the acquirer deposits the money from the transaction into the merchant’s account.

Of course, the services provided by each party in the chain of events come with a cost at each step, and the final total the merchant receives will be minus fees assessed by each party in the transaction.

The interchange fee is paid to the issuer.

The assessment fee is charged by the card networks.

The processor’s fee is collected by the processor.

How Long Should This Process Take?

Merchants can typically expect the entire process from initiation to funding to take anywhere from 24-48 hours. However, there are several different factors which can impact that time frame.

Time and day of the transaction

Region or country of the merchant

Specific bank policies

The merchant’s industry

Perceived risk levels

If at any point merchants begin seeing excessive delays for the posting of their funds or funds are not received at all, inquiries should be made immediately. A revenue hold should not be taken lightly; rather, it should be considered a warning that there is trouble with the current processing arrangement.

Fees

Wherever you’re selling, credit and debit card transactions probably account for a large chunk of your payments. So it’s important to understand how you’re being charged. This article will walk you through the components that make up your card processing fees and then deep-dive into the part that accounts for the highest proportion: Interchange.

Credit card processing comes with three fees:

Processing fee: Charged by your payment provider for processing the transaction

Card scheme fee: Charged by the card schemes for using their network

Interchange fee: Charged by the customer’s bank

When it comes to interchange, there are ways to bring your costs down.

These fees vary depending on the type of transaction, your location, and your business model (to name but a few). It’s confusing, but it can have a significant impact on your bottom line. The good news is, when it comes to interchange fees, there are ways to bring your costs down. But that’s only the case if you’re billed in a way that tracks the interchange rates (this is called Interchange++ – more on that later).

What are interchange fees?

Interchange fees are agreed by card schemes (Visa/Mastercard/Amex etc.) but are paid to the issuing bank (or customer’s bank). They’re usually the biggest expense when it comes to card processing. They’re also the biggest headache. The structure and fees vary for each market, as do types of cards (consumer debit, commercial debit, pre-paid and so on). And they change all the time.

Traditionally, there was very little transparency into how these fees were calculated. Large businesses with a high volume of transactions could negotiate lower fees, while smaller businesses were forced to pay the full amount. Markets dominated by the large international card schemes were most vulnerable because businesses could hardly refuse to accept the payment methods used by the majority of their customers.

Fortunately, in recent years, efforts have been made to standardize interchange with stricter rules, the introduction of fee caps, and an overall improvement in transparency.

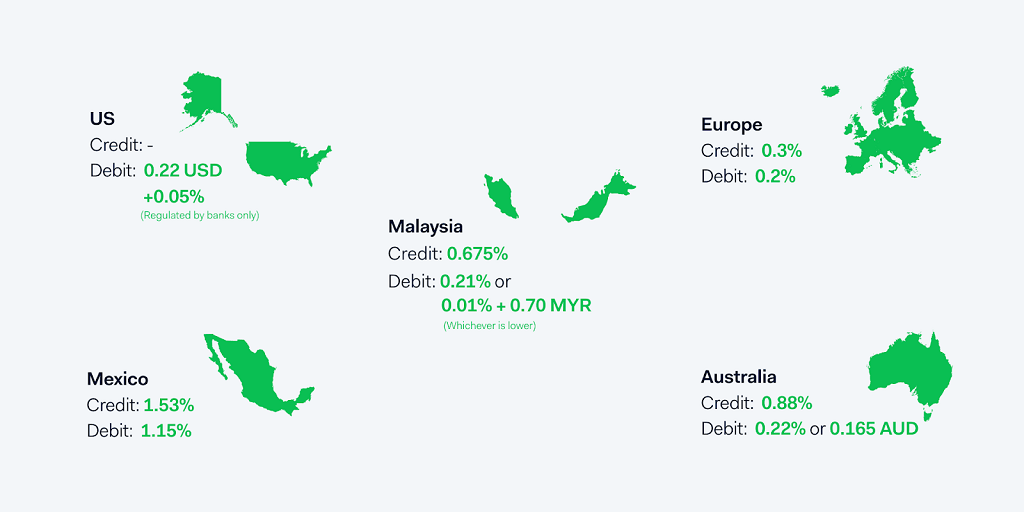

Below is a break-down of the fees caps across different regions:

TNote: US credit is unregulated and US debit applies to regulated banks only. Fee caps only apply to consumer cards in the US and EU. And, in Mexico, caps depend on industry and some rates are negotiable.

What impacts how much you pay?

Drivers that impact interchange fees include: region, sales channel, card type, and business model. Understanding these factors allows you to optimize the process and get the best rates. Here are some examples:

Local acquiring

Just like mobile roaming fees, transactions are generally cheaper if processed locally. Most developed countries have local acquiring available, however, in many emerging markets, this is still not an option.

Interchange++ vs. Blended

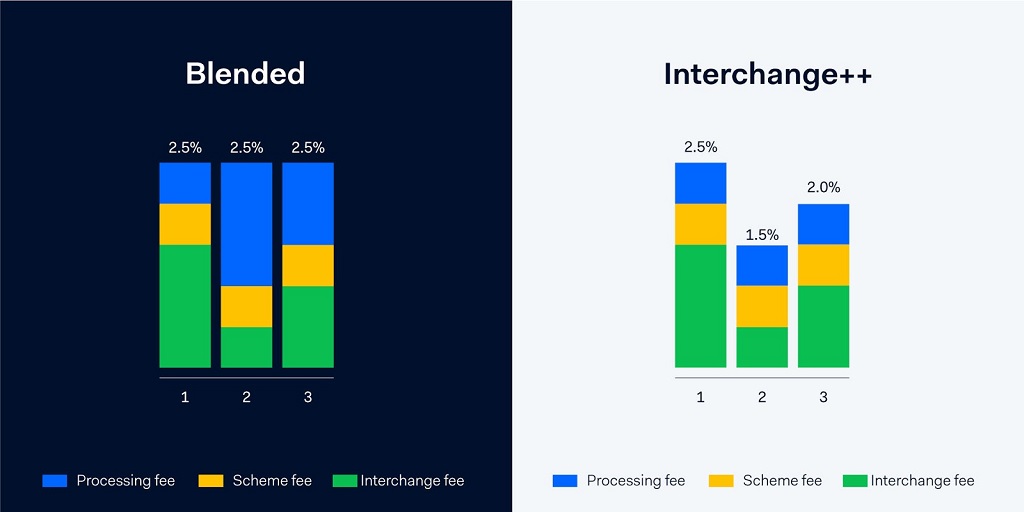

Interchange++ is a pricing model that tracks the interchange rates. For example, the fees cap across Europe has been a huge benefit for businesses billed with Interchange++ because when interchange goes down the saving is passed to you. To quote the Interchange Fee Regulation: “The outcome the European Commission expects is that merchants should know, for each transaction, the amount of the [Merchant Service Charge] and the interchange fee and are therefore able to check if the benefit of the regulation has been passed to them.”

The alternative to Interchange++ is blended pricing. Blended charges an average processing cost plus a fixed markup. You’re charged the same price for every transaction, which makes it easy to understand but it’s not transparent. You can’t see what you’re being charged for and there’s no guarantee your processor will pass on any savings.

Blended vs Interchange++ pricing: When interchange goes down, your costs go down

You get to see exactly what you’re charged for every transaction so there’s no danger of hidden costs.

Incentivized rates

Interchange fees vary from market to market. In the US and Australia, for example, Visa and Mastercard grant lower rates to specific businesses like charities, travel agents, streaming services, and utilities. Again, you only benefit from this saving if you are billed using Interchange++.

Card Present vs Not Present

What is a Card-Not-Present transaction?

A card-not-present (CNP) transaction occurs when neither the cardholder nor the credit card is physically present at the time of the transaction. It’s most common for orders that happen remotely — over the phone or by fax, internet, or mail.

A transaction is only considered to be “card present” if payment details are captured in person, at the time of the sale. This occurs when cards are physically swiped, tapped, or dipped through a reader or if an EMV chip is processed.

Examples of Card Not Present transactions

There are a number of CNP transactions that you probably come across everyday. They include:

Online purchases, when a customer buys goods on the internet or through an e-commerce transaction.

Phone orders, when a customer provides the credit card information over the phone to your business.

Recurring payments that are set up to bill automatically.

Invoices that are paid online.

How much does it cost to process credit cards remotely?

Just like processing credit cards in person, your business will have to pay to process CNP payments. As a refresher, the types of credit card processing fees that make up your rate are interchange fees, assessment fees (charged by card brands like Visa and Mastercard), Risk and PCI Compliance as well as your payment provider’s markup.

Generally, interchange fees are higher for CNP transactions because the chance of fraud and chargebacks is higher without the card present. These higher processing costs are then passed down to the merchant, which is why card-not-present transactions are usually more expensive than card-present transactions.

In 2018, CNP transactions made up 54% of all losses to fraud worldwide. Payments experts expect this number to gradually increase with the growth and adoption of e-commerce.

Understanding Card-Not-Present fraud and how to prevent it

Card-Not-Present fraud is a type of credit card scam in which a defrauder uses someone else’s compromised card information to make a remote purchase. Because both the card and cardholder aren’t physically present (and fraudsters often steal complementary information like the CVV and billing address), it can be difficult for merchants to verify the purchaser’s identity.

According to a 2020 Lexus Nexus True Cost of Fraud Study, every $1 of fraud costs U.S. retailers and e-commerce merchants $3.36 per transaction. It’s important to take proactive steps to stop credit card fraud – especially with CNP transactions.

According to a 2015 Merchant Risk Council (MRC) Global Fraud Survey, the two best, most commonly used methods for authenticating online transactions are card verification numbers (CVN) — the three or four digits on the back of the card — and negative lists, also known as blacklists.

3D Secure is also an effective way to verify the identity of the person claiming to own the credit card. Some payment processors, such as Hotel Link Pay, run a two-factor authentication via text or email so the cardholder can confirm the purchase.

Summary

Understanding all the processes and risks involved in payments can seem overwhelming. Getting a foundation of the knowledge shared above will certainly help your business avoid lots of painful situations and lost revenue in the future. For further information on how Hotel Link Pay, powered by Kovena, can assist you with payments industry knowledge please contact us with the form below.

Relative Posts

Payments | Benefits of an Embedded Payment System

Everything in our world is becoming faster, and to be competitive users expect nothing less…

Payments | What Do Chargebacks Mean for Your Business?

To understand how chargebacks work (and how they don't), it helps to have a basic…

Understanding about Front Desk

Front Desk is considered as a simple Property Management System specially designed for small and…